eKYC with Artificial Intelligence: A Roadmap for Businesses Amid Crisis

Sanam Malhotra | 1st June 2020

The team-up of artificial intelligence (AI) and the Know-Your-Customer (KYC) process is growing stronger amidst global shutdown. As financial institutions struggle to provide seamless customer services, AI is opening new opportunities to automate digital onboarding with eKYC. With cost and time efficiency, eKYC with artificial intelligence technologies is gaining momentum across global financial markets.

As a well-positioned AI Development Company, Oodles AI shares how AI solutions support lockdown-stricken delivery of banking and financial services.

KYC Challenges Facing Business Amid COVID-19

In the face of global lockdown, banks and financial regulators are under immense pressure for streamlining services while fulfilling due diligence responsibilities. Major challenges facing banks and FinTech companies amid the pandemic are-

a) Disrupted customer interactions

b) Limited human resources, and

c) Diminishing revenues.

The inability of banks and FIs to store, manage, and monitor large volumes of KYC data threatens to compromise their compliance standing.

Fortunately, in India, the RBI’s KYC amendment in January this year acted as a run-up to the lockdown-stricken operations. It proposes video-based KYC processes to strengthen the technological sophistication in the back office for banking, financial services, and insurance (BFSI) organizations. However, high demands for KYC digitization require robust technologies such as IoT and AI for banks to adopt digital onboarding and compliance.

How eKYC with Artificial Intelligence Revives Financial Services

Electronic KYC or online KYC (eKYC) is an emerging way of rendering financial services to customers via digital channels. The process requires a set of digital tools and technologies from video conferencing platforms to massive data storage and analysis frameworks.

With a spike in new loan requests amid crisis, eKYC is becoming an essential part of banking operations worldwide.

Artificial intelligence and its underlying machine learning techniques are all set to deliver on the eKYC requirements with effective automation. AI-led facial recognition, OCR, and fraud detection solutions are encouraging banks to effectuate eKYC processes with the following benefits-

1) Cost-effectiveness with as much as 90% reductions in onboarding costs

2) Process acceleration to speed-up identity verification and data storage

3) Operation resilience with streamlined automation while ensuring security and scalability.

Also read- AI Development for KYC: Business Guidelines and Applications

eKYC with Artificial Intelligence: Business Opportunities & Applications

1) Document Digitization with OCR

Digital copies of identity documents, such as ID cards, passports, and driving licenses are prerequisites for eKYC processes. However, manual methods of data extraction from these documents entail high costs and possibilities for erroneous entries.

Optical Character Recognition (OCR) systems are traditional tools for text capture and extraction from scanned documents. Now, powered by machine learning algorithms, AI-OCR applications can extract customer information from unstructured docs with agility and accuracy. AI-OCR is the first step towards implementing eKYC with artificial intelligence for BFSIs.

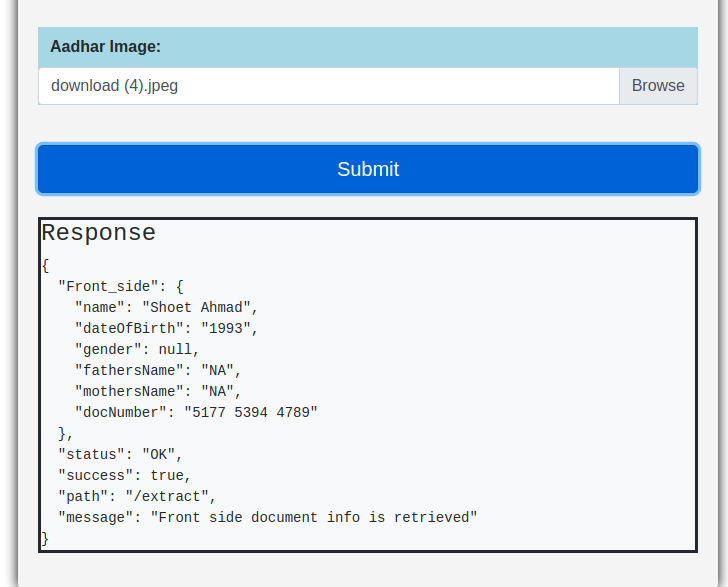

Recently, the Oodles’ AI team built an AI-OCR system that extracts text from ID cards, especially Aadhar with over 99% accuracy.

The AI-OCR tool automatically captures, extracts, and creates an editable and searchable copy of the customer data for an efficient KYC completion. AI-powered OCR can generate significant value for BFSIs not only for eKYC but also for financial spreading, credit risk management, etc.

Also read- How AI OCR for Financial Spreading Strengthens Risk Management

2) Facial Recognition with Computer Vision

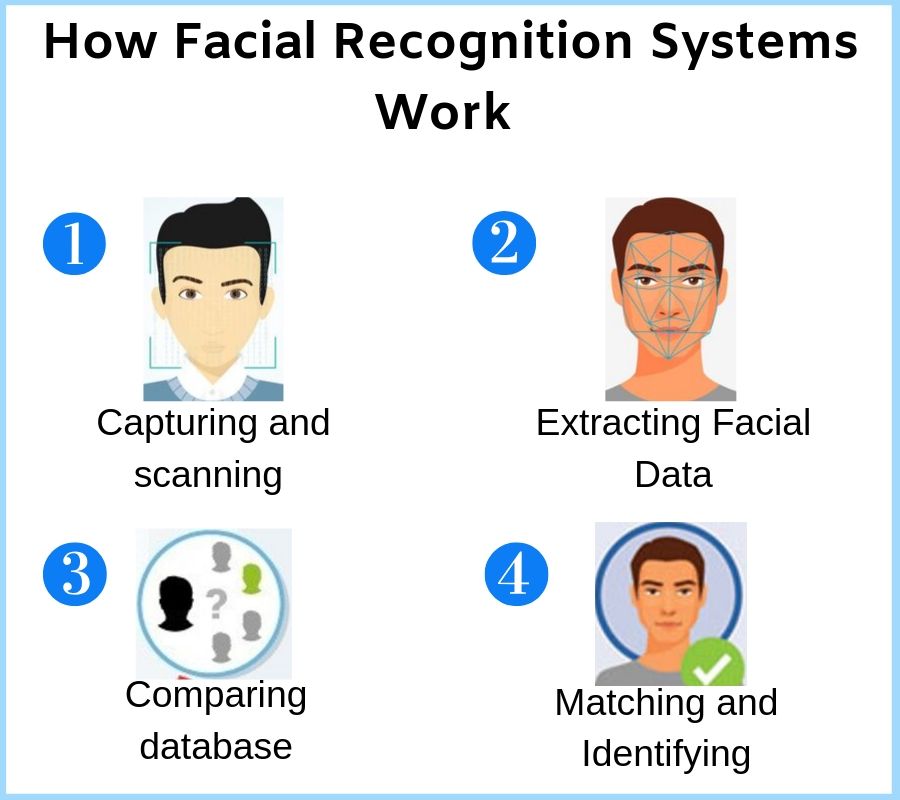

To ensure the authentication of video-based KYC processes, AI’s facial recognition technology is attracting many buyers from financial institutions. The technology is efficient at mapping distinct facial features from images and videos in real-time. Backed with deep learning algorithms, facial recognition generates a “unique face print” similar to fingerprints of applicants.

Under eKYC, facial recognition plays a vital role in detecting facial features and matching them with the data records. In addition, AI’s in-built analytics of trained models enable banks to detect fake images and provide in-depth insights.

Oodles’ AI team channelized facial recognition technology to automate employee attendance at offices through sensor-based CCTV cameras. The very technology is efficient at identifying customers for digital payments, eKYC, and other analyses.

Also read- AI for Video Analytics: Enterprise Applications and Opportunities

Deploying eKYC with Artificial Intelligence at Oodles

As the world grapples with the ongoing pandemic, the Oodles AI team is harnessing emerging technologies to build effective AI solutions for global businesses. Our team has experiential knowledge in delivering mission-critical AI solutions for BFSIs, healthcare, eCommerce, and other sectors. Our prep for eKYC with artificial intelligence involves hands-on experience in deploying machine learning and deep learning models for-

a) Facial Recognition

b) AI-powered Optical Character Recognition, and

c) Fraud Detection

In addition, our AI capabilities for financial services expand to predictive analytics for risk management, and chatbot development services for virtual customer assistance. Connect with our AI development team to explore more about our AI solutions and services.