AI Development for KYC: Business Guidelines and Applications

Sanam Malhotra | 7th February 2020

Artificial intelligence (AI) is poised to improve security across the financial landscape. From AI-powered surveillance to automated data extraction, AI technologies are optimizing security efforts for businesses and financial institutions. AI development services are set to disrupt legacy processes like Know Your Customer or KYC for improved verification and enhanced customer experience. AI development for KYC deploys technologies like computer vision, Natural Language Processing (NLP), and machine learning for significant value generation.

In this article, let’s unfold the impact of AI in KYC automation with advanced applications.

Traditional KYC Process

The traditional KYC process is laden with multiple layers of verification stages, both manual and digital. The process begins with the collection of data from millions of customers including prodigious volumes of documents and files. The next step involves manual validation of customer data that make KYC time-consuming, high-cost, and risk-based operation. On top of it, the continuous need for updating customer data in business logs challenges KYC completion with accuracy and efficiency.

According to Mckinsey’s Lab Research,

“Since 2009, banks worldwide have paid over $30billion in penalties for failing to resolve financial crimes.”

In addition to these challenges, the current KYC process often fails to address security concerns and queries arising from customers. A customer’s application can be off-boarded at any stage due to innumerable compliance issues or quality controls. Consequently, today banks are struggling to clear a large backlog of KYC applications resulting in rising financial crimes and data insecurity.

How does AI Development impact KYC

Artificial intelligence is making remarkable strides in the data analytics domain due to dynamic data processing and validating capabilities. Businesses are beginning to capitalize on AI’s data extraction and processing capabilities to ingest value-based automation in critical KYC processes, such as-

a) Data Extraction and Verification

b) Fraud Detection, and

c) Anti-money laundering Compliance

Let’s take a closer look at how businesses can channelize artificial intelligence services for an accelerated KYC process and enhanced customer experience.

Effective AI Development Techniques and Applications for KYC

1) Multiple Layers of Automated Verification

Though financial institutions have been at the forefront of digital transformation, manual intervention for data analysis remains an inevitable challenge for banks. Artificial intelligence opens new opportunities for financial institutions to introduce automation to the KYC process.

Algorithmic advancements and data-driven machine learning development services are key enablers of KYC automation. Here are some innovative AI applications for KYC-

a) Computer Vision for Facial Recognition

ML libraries like OpenCV and TensorFlow can train models for facial detection and gesture recognition of individuals and digital images. Banks can also integrate computer vision solutions in their cloud infrastructure for real-time image processing, analytics, and detect facial spoofing.

b) OCR for document verification

Optical Character Recognition or OCR enables text recognization and extraction from unstructured data such as ID cards, passports, driving license, and PAN Cards. Document verification with OCR can also automate validation of customer signature and detection of anomalies.

Also read- AI-powered Optical Character Recognition for Global Businesses

2) Real-time Fraud Detection

The lack of any standard process cycle for KYC operations makes it difficult to comply with money laundering laws and data security protocols. Poor KYC security systems put consumer’s data in vulnerable hands and prevent companies to achieve anti-money laundering compliance.

With the advent of AI, banks and businesses can rely on machine learning capabilities for real-time fraud detection. Banks can detect fraudulent behavior among customer by deploying the following AI development techniques-

a) Supervised and Unsupervised Machine Learning models

The pattern recognition abilities like data tagging of customer data can categorize fraud and non-fraud patterns. In addition to training models, self-learning systems powered by unsupervised learning can learn itself from system errors and anomalies.

b) Predictive analytics for early fraud detection

AI’s predictive capabilities can also prevent the entry of illegitimate KYC applications by categorizing most likely fraudulent early in the process. Automatic question and answering systems can extract valuable information from customers who suggest higher risk.

Also read- Mobilizing Big Data for Cloud-based Predictive Analytics

Exploring AI Development for KYC with Oodles AI

AI-driven transformation is projected to add a layer of automation in almost every industry. At Oodles, we combine our AI development forces with machine learning algorithms to build seamless verification models for financial institutions. Our most recent development in this field involves the deployment of ML-based APIs to validate customer documents and images in the form of-

a) PAN Card

b) Adhar Card

c) Passports, and

d) Voter ID Cards

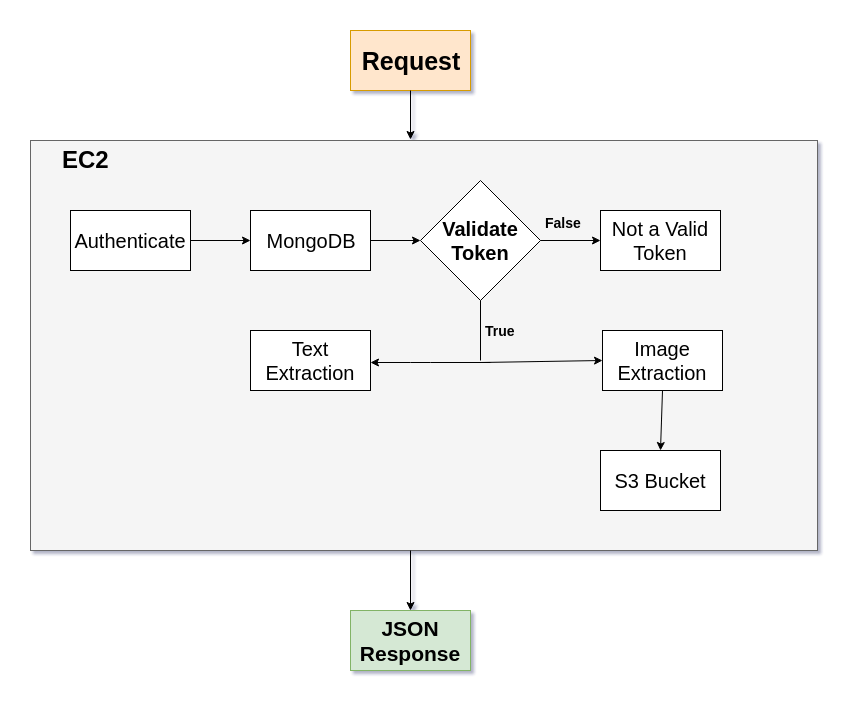

The model uses MongoDB to authenticate customer data through tokens. Valid customer data will be stored in the S3 bucket along with image URL and textual information. The model then returns all the actionable data in a JSON file with the concerned system.

Besides, our machine learning capabilities for KYC automation extend to AI-powered computer vision, NLP, and OCR technologies.

Reach out to our AI development team to learn more about our artificial intelligence services.