How AI OCR for Financial Spreading Strengthens Risk Management

Sanam Malhotra | 12th May 2020

In the run-up to automation, artificial intelligence (AI) is remarkably transforming several industry-specific processes with added value. For financial services, AI is set to automate tedious tasks such as financial spreading that involves intensive data entry and analysis. With algorithmic advancements, financial firms can combine traditional OCR scanning services with machine learning algorithms. Read on to explore how AI OCR for financial spreading strengthens and accelerates credit risk management processes while developing significant analytics capabilities.

AI OCR for Financial Spreading: How it works

Financial spreading lays the foundation for critical business decisions for banking and financial services. For financial firms, reviewing data and spreading financial information is an imperative way to aid strategic decision making and risk assessment. However, the traditional practice of manually handling financial statements entails erroneous entries, high operational costs, and unreliable analysis.

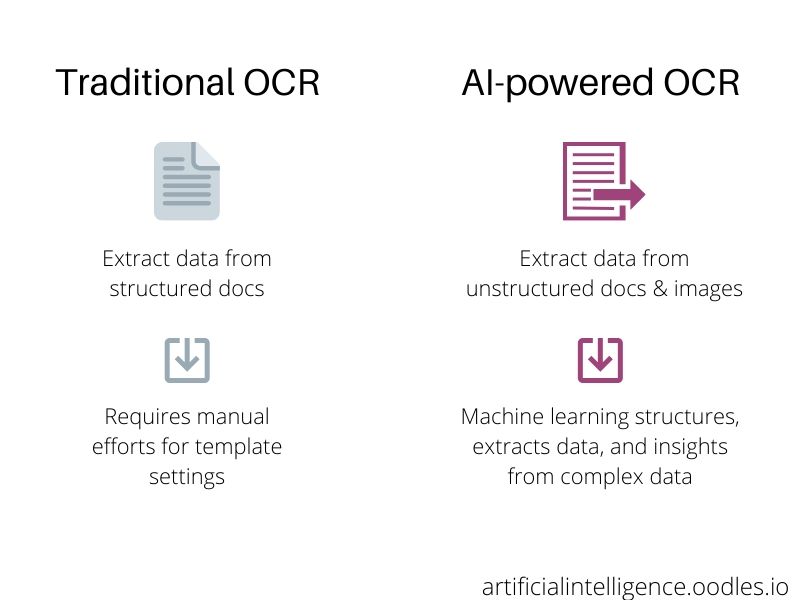

The combination of artificial intelligence services and Optical Character Recognition (OCR) systems present an automated, efficient, and more intelligent way of maintaining financial databases. AI-powered OCR can not only digitize scanned financial copies but also turn them into readable and searchable datasets available across channels.

In contrast to conventional OCR systems that are restricted to minimum fonts and formats, AI OCR for financial spreading are able to-

a) Identify and extract text from unstructured images and formats

b) Digitize invoices, bills, financial reports, and

c) Archive voluminous documents with editable and searchable functionalities, and

d) Understand and translate data in multiple languages to ease analysis.

At Oodles, we employ various machine learning libraries and frameworks along with Python programming to build AI OCR for financial spreading.

Here’s a step-by-step guide on how we achieve 99% precision in capturing and extracting complex financial data by building deep learning models-

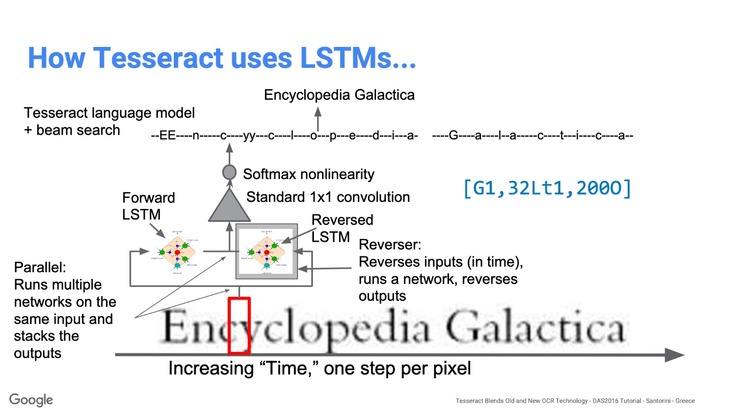

Step 1: Installing the open-source OCR engine, Tesseract

Tesseract is an OCR software run by Google that infers text from scanned images with features like character classification, segmentation, and layout analysis. The latest Tesseract tool comprises of new neural network subsystems that use LSTM to recognize texts, columns, images, and layout from inputs.

Step 2: Preprocessing Images for Tesseract

In the next step, we need OpenCV, an open-source computer vision and machine learning library to preprocess input images and improve model performance. The library is a storehouse of different techniques like changing image colorspaces, geometric transformations, thresholding, smoothing, and more to process different images.

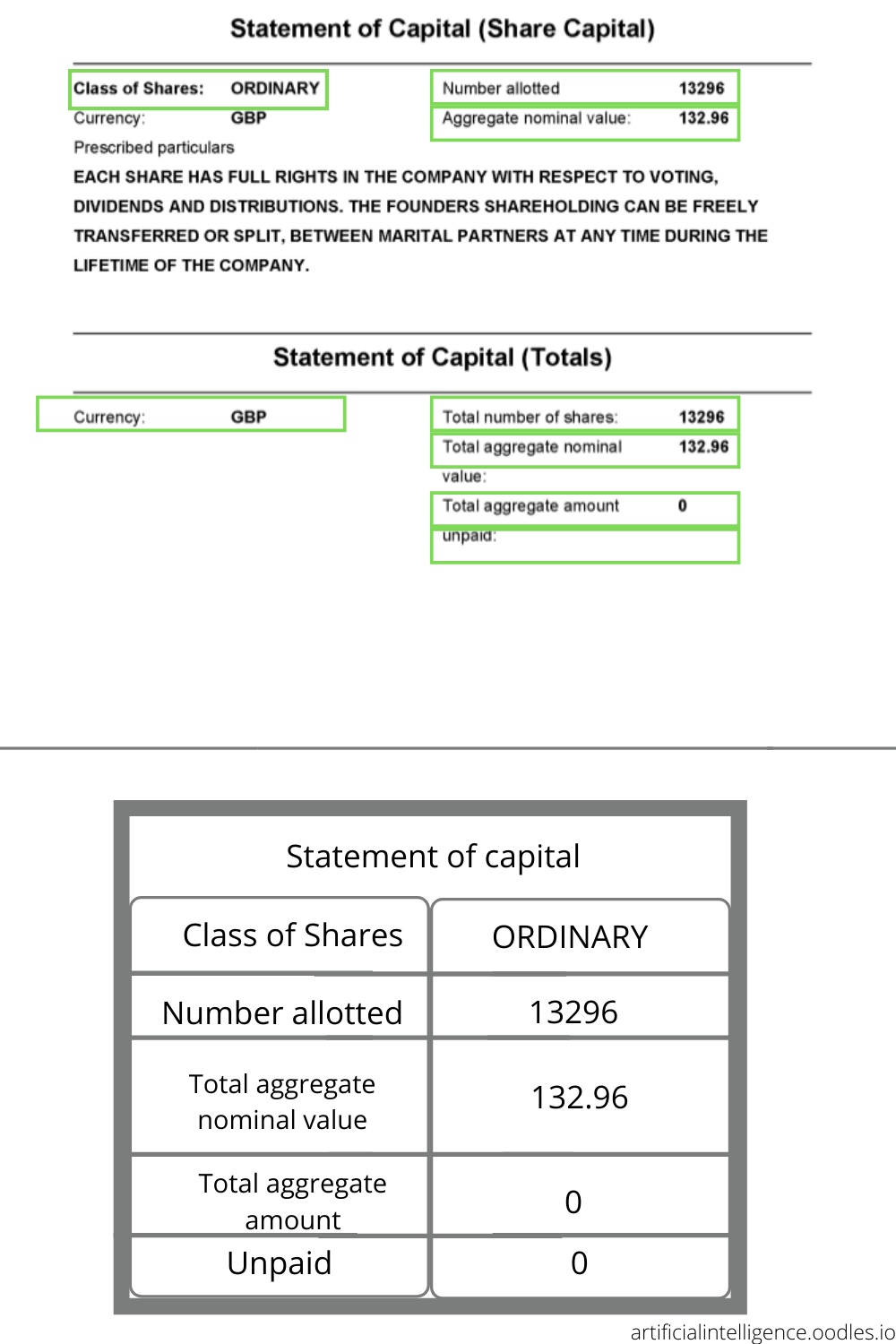

Here’s a quick demo of a sample invoice being processed by AI OCR for financial spreadsheets-

Once the model gets rolling, we can use Python-tesseract to bound text in images within boxes. PyTesseract is an OCR tool for Python that can read and extract text from all types of images including jpeg, png, gif, tiff, etc.

Also read- Improving Data Analysis with AI-powered OCR Applications

Significance of AI OCR for Financial Spreading

1) Intelligent Document Processing

AI OCR for financial spreading is a step towards embedding cognitive intelligence into legacy banking and financial systems. The systems incorporate advanced AI technologies such as Natural Language Processing (NLP) and machine learning algorithms to augment business intelligence and analytics.

2) Better Credit Risk Management

Machine learning and OCR systems together bring cognitive intelligence to credit risk management processes by automating critical data maintenance tasks. It enables risk management teams to better concentrate on assessing credit risk and serving customers. AI’s accurate data capture abilities improve the quality of credit decisions and develop personalized investment products for clients.

3) Reduced Operational Costs

Information extraction with machine learning not only promises accuracy but also time and cost efficiency to businesses. AI replaces manual efforts for data entry with cost-effective tools and technologies that raise profitability gains and achieve greater efficiency than humans.

4) Innovative Application Development

As an enabler of speedy, precise, and effective financial spreading, AI OCR drives significant value for advisors to deliver well-informed decisions. Also, organized data encourages financial strategists to develop transformative applications that provide greater agility to businesses in the long run.

Also read- Machine Learning and Augmented Analytics to Optimize Business Intelligence

Building AI OCR for Financial Spreading with Oodles AI

We, at Oodles, are a team of experienced AI developers, and analysts who harness the power of AI technologies for automating critical business processes. Our team has hands-on experience in building and deploying machine learning-based OCR systems for extracting actionable information from-

a) Identity cards such as Aadhar card, PAN card, passports, etc.

b) Invoices, legal documents, and financial statements

c) Healthcare reports, insurance agreements, and lab tests

d) HR documents, survey forms, and applications.

To build efficient AI OCR systems, we employ cloud-based frameworks such as Google Cloud Vision API, ML libraries like OpenCV, and engines like Tesseract. Our team has successfully built and optimized OCR solutions for various applications, such as-

b) Healthcare data management

c) Digital onboarding, and

d) Financial Report Processing

Connect with our AI development team to discover more about our AI-powered OCR services.