How Banking Chatbots are Transforming Financial Services

Sanam Malhotra | 28th December 2019

Banking chatbots are transforming the way financial institutions connect with their customers. Artificial intelligence (AI) backed chatbots for financial services such as banking, insurance, and wealth management are improving the customer experience across digital channels. From enhanced customer support to personalized budgetary advice, chatbot development services are automating the banking sector with notable success.

This blog post highlights how applications of financial chatbots are changing the future of banking operations.

Key Functionalities of Banking Chatbots

1) Improved Customer Support

Customer support is at the heart of the banking industry However, the current state of unempathetic banking services fails to understand customer needs and resolve their queries effectively.

AI-powered automation is propelling new and efficient opportunities in consumer banking with automated chatbot solutions for-

a) Addressing Customer Queries

Assisting customers in making well-informed decisions with accurate and speedy information systems. Chatbots powered by natural language processing techniques can process complex user queries like certain life insurance plan details or calculating EMIs.

b) Scheduling Appointments

In the case of unrecognized queries, chatbots with advanced algorithms are performing beyond the “Sorry, I didn’t get you” message. Such complex queries are automatically directed to the concerned executive for better redressal of consumer grievances.

Also read- Automating Business Interactions with Whatsapp Chatbots

2) Effective Lead Generation

Diversified customer needs and preferences make it difficult for banks to develop and maintain an immersive user experience across digital channels. Moreover, modern-day customers are well past traditional lead generation methods such as spam emails and cold calls.

Artificial intelligence services embed cognitive abilities into banking portals to maintain an interactive and immersive experience round the clock with chatbots. Bankings chatbots take a subtle approach in connecting with potential customers for-

a) Understanding customer needs and suggesting the appropriate services in time.

b) Adding a novelty factor to the bank’s digital channel to keep customers engaged and interested.

c) Triggering sales leads by collecting relevant customer data that can be later used by marketing personnel to make follow-up efforts.

Also read- Enhancing Customer Engagement with Conversational AI Chatbots

3) Fulfilling Investment Recommendations

Banking operations and interactions generate tonnes of valuable data every year. With technological advancements, banks are beginning to realize this value using big data analytics.

IDC’s Semiannual Big Data and Analytics Spending Guide 2016 reveals that the banking sector invested over $20.8 billion in big data analytics in 2016.

Banks can use the insights generated from big data analytics to create intuitive conversational interfaces with chatbots that-

a) Analyze customer’s data such as spending habits and incomes to provide credit scores, manage budgets, prepare smart spending guides, etc.

b) Also, chatbots can provide AI-powered recommendations including personalized offers and advice to customers.

c) Informative notifications and multimedia messages such as educational videos on finance and budgetary planning make chatbots a valuable asset for banks.

Also read- Conversational Banking: Future of Banks with Chatbots

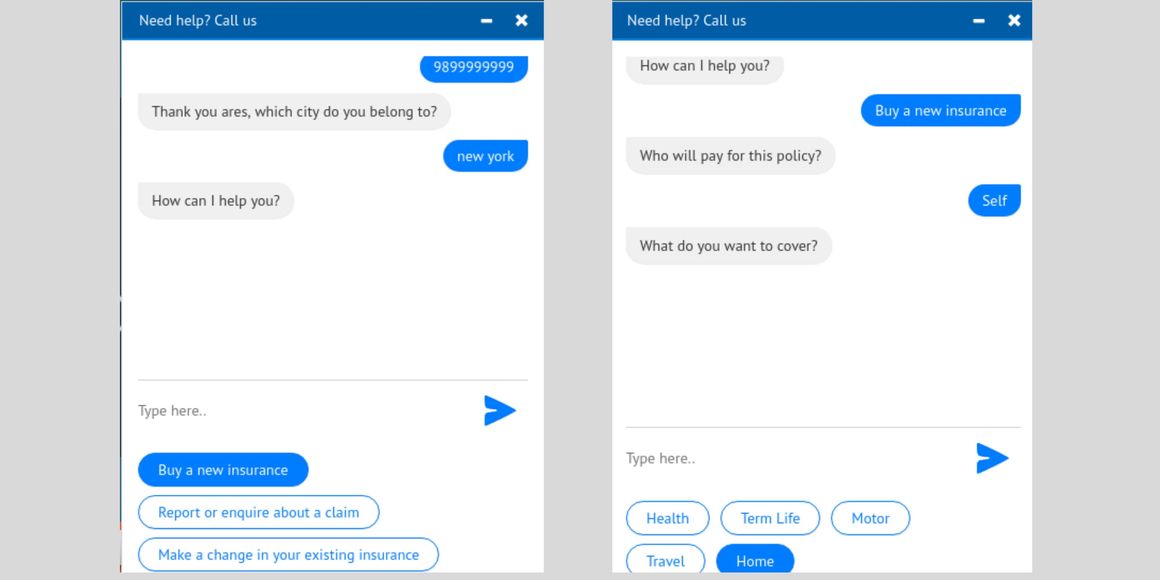

Integrating AI-powered chatbots for Financial Services with Oodles AI

We, at Oodles AI, have hands-on experience in training AI-powered chatbots with relevant customer data to build intelligent conversational interfaces. Our AI team enables banking and insurance businesses to analyze and respond to customer needs with natural language-based chatbots. Here’s a recent insurance chatbot built by Oodles AI for a global medical institution-

The chatbot assists online customers in planning and fetching accurate details about multiple insurance services.

In addition, we provide chatbot integration services across digital channels such as Facebook, WhatsApp, Slack, Telegram, etc. Also, we have adept knowledge in building AI-powered chatbots using various frameworks such as IBM Watson, Dialogflow, Amazon Lex, and more.

Talk to our AI team to know more about our artificial intelligence and chatbot development services.