Potential of Machine Learning in Payments Amidst Crisis

Sanam Malhotra | 7th May 2020

The payment industry is experiencing tectonic shifts as the world fights the COVID-19 crisis. The immediate challenges facing the transaction infrastructure includes restricted physical payments, slammed retail and commerce, declined B2B cashflows, etc. In this phase of global uncertainty, artificial intelligence (AI) is emerging as a propeller for digital businesses. Machine learning in payments is enabling banks, FinTech players, and payment providers to join forces and support customers in online purchases.

As a well-established provider of machine learning development services, Oodles AI explores some innovative AI solutions to reboot the payment industry.

How Will COVID-19 Impact the Payments Industry

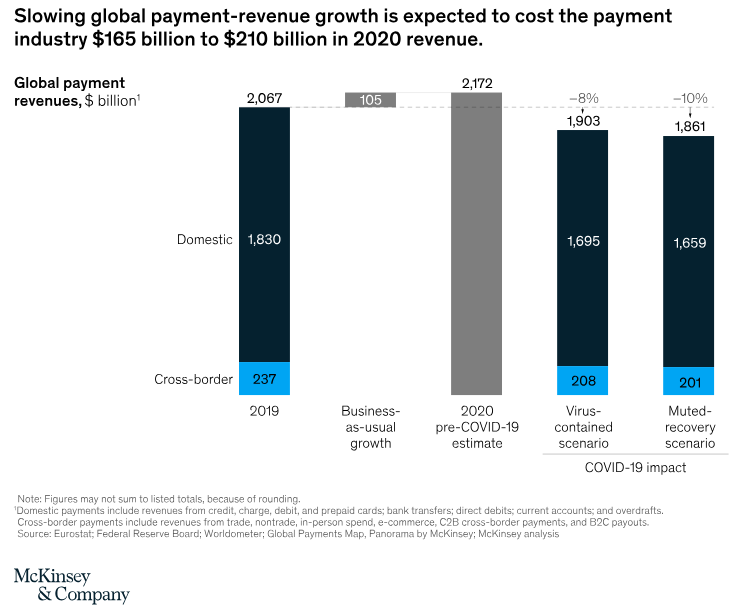

The ongoing coronavirus pandemic is projected to have long-term implications on the global payment industry. Mckinsey suggests that sectors like airlines, tourism, and retail are witnessing a massive impact of continuing global shutdown including-

a) Reduced cross-border transactions

b) Disrupted supply chains and B2B transactions, and

c) Decreased retail and point-of-sale payment volumes.

The global consultancy projects a negative revenue growth for the payment industry due to declining economic activities and changing consumer patterns.

To counter the downfall, the wider financial sector is adapting to the “new normal” by innovating payment infrastructures worldwide. For contactless transactions, global payment firms are shifting their focus on digital methods of payments, such as-

a) Contactless payments using RFID technology and virtual cards

b) Remote-commerce facilities for small merchants

c) Mobile wallets and tap-and-go checkouts at supermarkets

d) Payment services through popular communication apps like WhatsApp, and more.

“We cannot imagine going to physical banks anymore”

Also, the coronavirus transition is encouraging banks to partner with FinTech players to promote digital transactions among customers. Raj Phani, Founder and Chairman of Zaggle, highlights the upcoming trends in the payment and Fintech industry saying-

“With banking data and services opening up, fintech players would come with so many innovative and disruptive ideas by combining AI/Blockchain along with massive banking data that we cannot imagine any business or even individuals going to Physical Banks anymore in future.”

That said, let’s explore how payment providers, banks, and FinTech companies can harness artificial intelligence development services to stay afloat and support customers.

Machine Learning in Payments: Applications and Opportunities Amidst Crisis

1) Computer Vision for Authorized Access

AI’s vast set of technologies including computer vision is gaining momentum amidst coronavirus lockdown with its contactless identity recognition capabilities. Powered by machine learning algorithms, computer vision is beginning to disrupt traditional POS systems and waiting queues at supermarkets.

A customer is trying her hands on a facial recognition system to pay for her purchases at a store in Wuma Street, China. (Source- ChinaDaily)

A customer is trying her hands on a facial recognition system to pay for her purchases at a store in Wuma Street, China. (Source- ChinaDaily)

The current lockdown conditions are ideal to experiment with machine learning in payments for automating online access to payment gateways and check-outs. Here’s how businesses can reflect loyalty and security in payments with these computer vision-based payment solutions-

a) Facial recognition systems for accessing payment systems and making payments

b) Sentiment analysis for offering hyper-personalized offers and products

c) Deep video analytics for strengthening retail infrastructures and analyzing customer behavior, etc.

Also read- AI-driven Conversions: Computer Vision Applications for eCommerce

2) Personalized Products and Customer Experiences

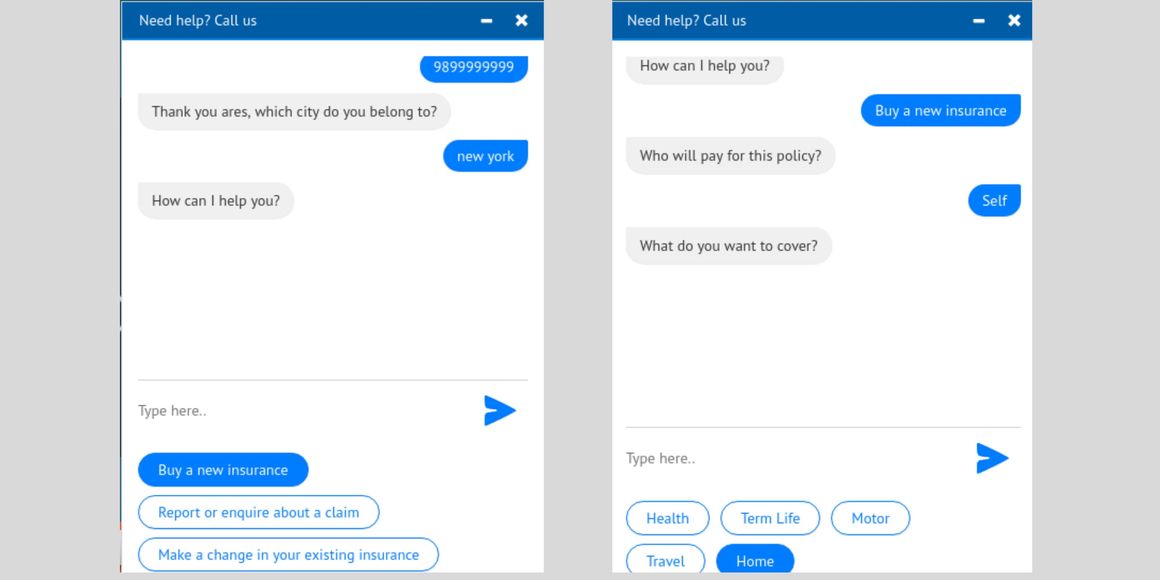

With rapid digitization in banks and payment windows, data analysts are able to feed machine learning models with qualitative and quantitative data. We, at Oodles, are witnessing a high demand for AI-powered chatbots that not only standardize customer interactions but also collect often overlooked customer data. It enables businesses to get deeper insights into customer preferences, needs, and pain points driving more personalized solutions.

In the face of the COVID-19 crisis, machine learning in payments is propelling personalized products by analyzing prodigious amounts of customer data. Some of the most interesting AI solutions for personalizing banking offers include-

a) Customized insurance product offerings based on customer demographics

b) Alternative recurring payment options like cards, or monthly installments, based on customer’s payment patterns and affordability

c) Omni-channel payment solutions to support commerce across borders, and more.

Also read- Keeping Businesses Afloat With AI During COVID-19 Crisis

Harnessing Machine Learning in Payments with Oodles AI

The possibilities of AI and machine learning in payments and transaction businesses are expansive. At Oodles, we are constantly experimenting with AI technologies such as computer vision, OCR, NLP, and chatbots to build enterprise-ready AI applications.

Our recent insurance chatbot in action.

Our recent insurance chatbot in action.

In the payments ecosystem, our team has hands-on experience in building and deploying the following machine learning models-

a) AI-powered OCR systems for digitizing voluminous and unstructured financial documents systematically and extracting insights

b) Banking and insurance chatbots for augmenting customer outreach, up-selling, and cross-selling efforts

c) Facial recognition and deep video analytics for automating payment processing and check-outs, and more.

Connect with our AI development team to discover how we are strengthening businesses to fight the COVID-19 crisis with our artificial intelligence services.